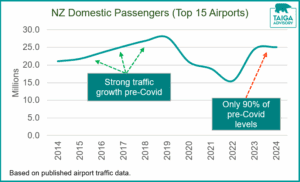

Domestic passenger numbers for New Zealand’s top 15 airports were only 90% of pre-Covid levels in FY2024. That’s a tough environment for any business sector – and not surprising given Air New Zealand’s well documented engine issues, a chronic shortage of domestic airline competition, and wider economic challenges.

For New Zealand regionals, the recovery has been uneven. Standouts like Tauranga and Invercargill Airport Limited have exceeded 110% of pre-Covid traffic, while others remain stuck in the 80-90% recovery band. Jetstar’s 2019 exit from New Zealand regional turboprop services has been a major handbrake on growth.

Looking back in time: in the half decade leading up to Covid, New Zealand’s domestic market averaged a very solid 6% compound annualised growth rate to FY2019 – well ahead of real GDP growth, and much stronger than the Australian domestic market (only 1.2% annualised). It’s an encouraging reminder of the NZ market’s potential when conditions are right!

For airports, a well-crafted revenue roadmap is essential to building financial resilience. This captures strategies to optimise per pax yields and build appropriate revenue diversification, including income streams with less correlation to pax flows (say property development). Ultimately, this helps maximise airport earnings regardless of the growth environment.

Taiga Advisory are experts in airport financial strategy. With deep experience in airport financial and commercial management, we provide practical, hands-on support. Get in touch to learn more.