For almost every airport, aeronautical revenues are the cornerstone of financial performance. In basic terms, these revenues are driven by an airport’s aeronautical pricing, together with traffic volumes.

Robust aeronautical pricing is crucial to an airport’s financial success and sustainability. So how does this actually work?

Airports in Australia operate under a “light-handed” regulatory regime – which means government does not play a direct role in setting of aeronautical pricing (also known as aeronautical or airport charges).

The Australian Competition and Consumer Commission (ACCC) undertakes price and quality of service monitoring for Australia’s four largest airports only (Sydney, Melbourne, Brisbane and Perth), with no formal role beyond these ports. This is quite different to many other jurisdictions, for example the regulatory price cap system generally seen in Europe.

In a nutshell – the Australian regulatory approach is meant to generate commercially negotiated outcomes between airports and airlines. This is laid out in the Australian Government’s Aeronautical Pricing Principles (APPs), which describe how airports should determine aeronautical charges.

The APPs are generally acknowledged by both airlines and airports as providing a sound platform for determining charges. The APPs aren’t legally binding, however, and are open to interpretation in how they actually apply – a key reason why Australian airports and airlines end up in dispute (and even litigation) from time to time.

Despite these limitations, the APPs are the closest thing to a rulebook as exists in the Australian system.

In negotiating with airlines, airports frequently use an aeronautical “building block model” approach to determine their proposed charges – following the spirit of the APPs.

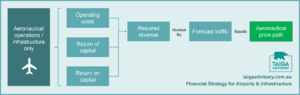

The building block model works out aeronautical charges by “building up” the cost of providing aeronautical services. The fundamental elements are:

- A return on capital, based on the airport’s aeronautical asset base and weighted average cost of capital (WACC)

- A return of capital, based on depreciation of aeronautical assets

- Operating expenditure required to deliver aeronautical services

This delivers an aggregate estimate of “required” revenue, reflecting a fair and justifiable return to the airport. This allows aeronautical pricing to be calculated on a per-unit basis – for example as a per-passenger charge.

The building block model is generally prepared for a multi-year period (say 5 years), encompassing the airport’s proposed capital expenditure, forecast growth and numerous other inputs. This generates a price path of proposed charges which underpins negotiations between the airport and its airline partners.

Among many points of contention – the appropriate return on capital the airport should achieve (the WACC), and the scope/cost of the airport’s proposed capex plan. Airports and airlines can often have wildly divergent views, resulting in a sizeable gap in perceptions on “reasonable” charges. In an ideal negotiation, these issues are resolved through a constructive, good faith process of engagement and information sharing.

Airports will commonly segregate their charges into an airfield component and a terminal component, and similarly between domestic and international facilities. This aligns each charge to the underlying cost of delivering the related aeronautical segment and its infrastructure.

Robust aeronautical pricing is a key pillar in effective airport financial strategy. Strong aeronautical yields underpin earnings, drives airport valuation, and provides the commercial ”line of sight” to support aeronautical infrastructure works – for example a major terminal upgrade, or a new runway. It can also be deployed by the airport as a strategic lever – for example to incentivise airline capacity growth, or to support new and untested routes.

Taiga Advisory are experts in helping airports develop highly effective aeronautical pricing. Large or small, we help airports unlock significant value through practical, hands-on consulting services. We help you craft an effective aeronautical pricing strategy, develop a robust pricing model, then successfully negotiate with your airline partners. Get in touch to learn more.