Airport profitability is a topic of considerable discussion. So, what do airport earnings look like in Australia and New Zealand?

Major airports have obvious advantages in scale, geography and market power – providing a lucrative and resilient earnings profile. It is no surprise that 14 of Australia’s top 15 airports (by passenger traffic) are privately owned – they are highly attractive investments.

Nevertheless, smaller airports can also achieve strong returns through effective financial and commercial strategies – optimising their value proposition (to passengers, airlines and other commercial partners), maximising competitive advantages relative to larger airports, and driving synergies between aero and non-aero revenue streams.

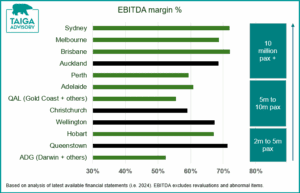

Below is a snapshot of EBITDA margin for a select group of medium / large airports – reflecting the 2023/24 financial year (or 2024 calendar year, depending on the airport’s reporting cycle).

Taiga Advisory closely tracks the financial performance of airports in Australia and New Zealand. Our understanding of airport financial dynamics is pivotal in driving better financial strategy for our clients – regardless of airport size. We work with a great group of airports from 200,000 pax to 5m+ pax. Get in touch to learn more.